I have enjoyed extremely lucrative returns from my investment in shares over the last few years. I must go back and see exactly when I started building my latest portfolio, just out of curiosity and to get a good handle on my annual returns.

But I am chuffed at the returns I have seen from what have been fully passive investments after the initial purchase.

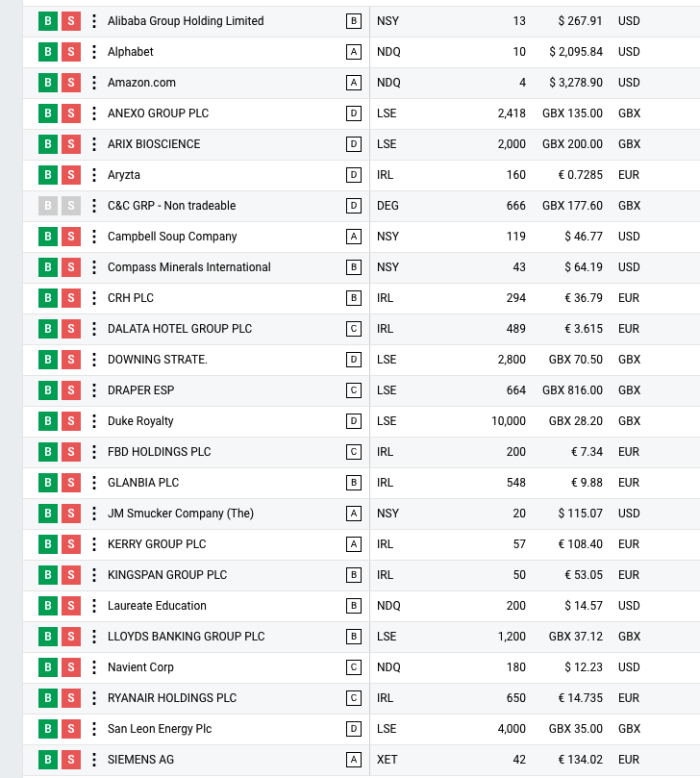

However, I am considering tweaking my strategy. What I am thinking about doing is whittling down the number of holdings by a significant percentage and concentrating my investments in a smaller number of shares.

And these shares would be ones which I choose carefully and would be companies whose products I like or use or both, and which might be candidates for more spectacular growth in the future.

For example, I hold shares in Ryanair, Smurfit Kappa, and Snap inc. Of these three Snap is the obvious candidate to show more exponential growth in the future. Smurfit and Ryanair are mature companies in mature industries. Nothing wrong with that and they will, as they have in the past, show solid, steady growth and dividends.

But they do not have the type of upside potential that Snap inc. might have.

So, that’s the plan.

If you are interested in learning about investing in shares you may be interested in my online investment course. You can learn more about that here.