I published a video on my YouTube video earlier this week and it quickly became my top performing video on my channel ‘compared to your typical performance’.

The ‘ranking by views’ metric was 1 of 10 and there were 16 comments, all of them positive and many asking for more videos of a similar nature.

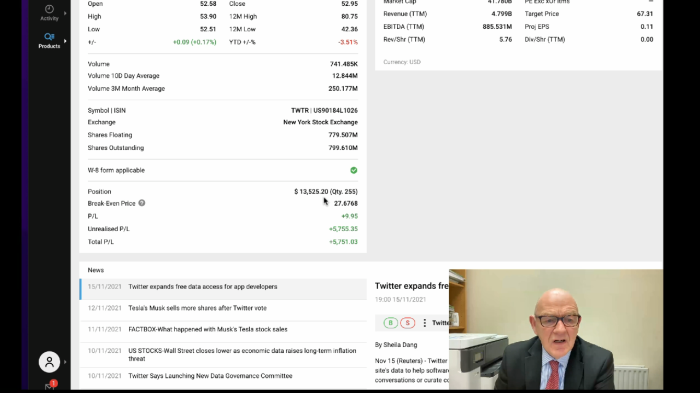

The video is about selling my Twitter shares at a 93.8% profit and why I would consider selling any share. And the reason would not be to take a profit, it would be to replace the share with what I would believe is a better one for the medium to long haul.

There is one further reason why I might sell a share and that is a liquidity or cash flow requirement. At the moment that is a reality as it is tax time for small business owners like me and we must find, if we have made a profit, money for the Revenue Commissioners and probably money for a private pension to try to minimise the tax liability.

I have previously observed a surprising level of interest in stocks, shares and investing generally. I could have anticipated interest in property investing given the love affair Irish people have with property but the level of interest in shares investing surprised me, I must admit.

I have created an online course about investing in both property and shares drawing on my own experience in investing in both of these asset classes. When I launched that course I had a few queries from persons who were interested in the shares section only and enquired if it was possible to just buy the part dealing with shares.

It wasn’t at the time but now I am seriously considering launching the shares section as a standalone product.